This article takes a different view. By stepping back from the next twelve months and looking at longer-term trends, it highlights several developments that may not grab headlines today but could meaningfully shape the outlook for 2026 and beyond.

It can sound clever to be pessimistic about the future. Scepticism often passes for wisdom. And so, every year – right in the middle of the so-called “most wonderful time of the year” – inboxes fill up with gloomy, risk-heavy forecasts.

The problem is that most of these outlooks are tightly focused on the next twelve months. In doing so, they miss the bigger picture of progress.

Take solar energy. Solar panels become roughly 8% cheaper each year. That barely registers in a single year. But over two decades, the effect is dramatic – solar panels now cost around one tenth of what they did in 2005.

Or consider global life expectancy. Since the turn of the millennium, it has increased by roughly three months per year. Not headline-grabbing annually, but over time that equates to around six additional years of life, on average, across a global population of eight billion people.

With that longer-term lens in mind, here are several developments that may look incremental today, but could meaningfully add up as we look ahead to 2026 and beyond

Broadening, not bursting

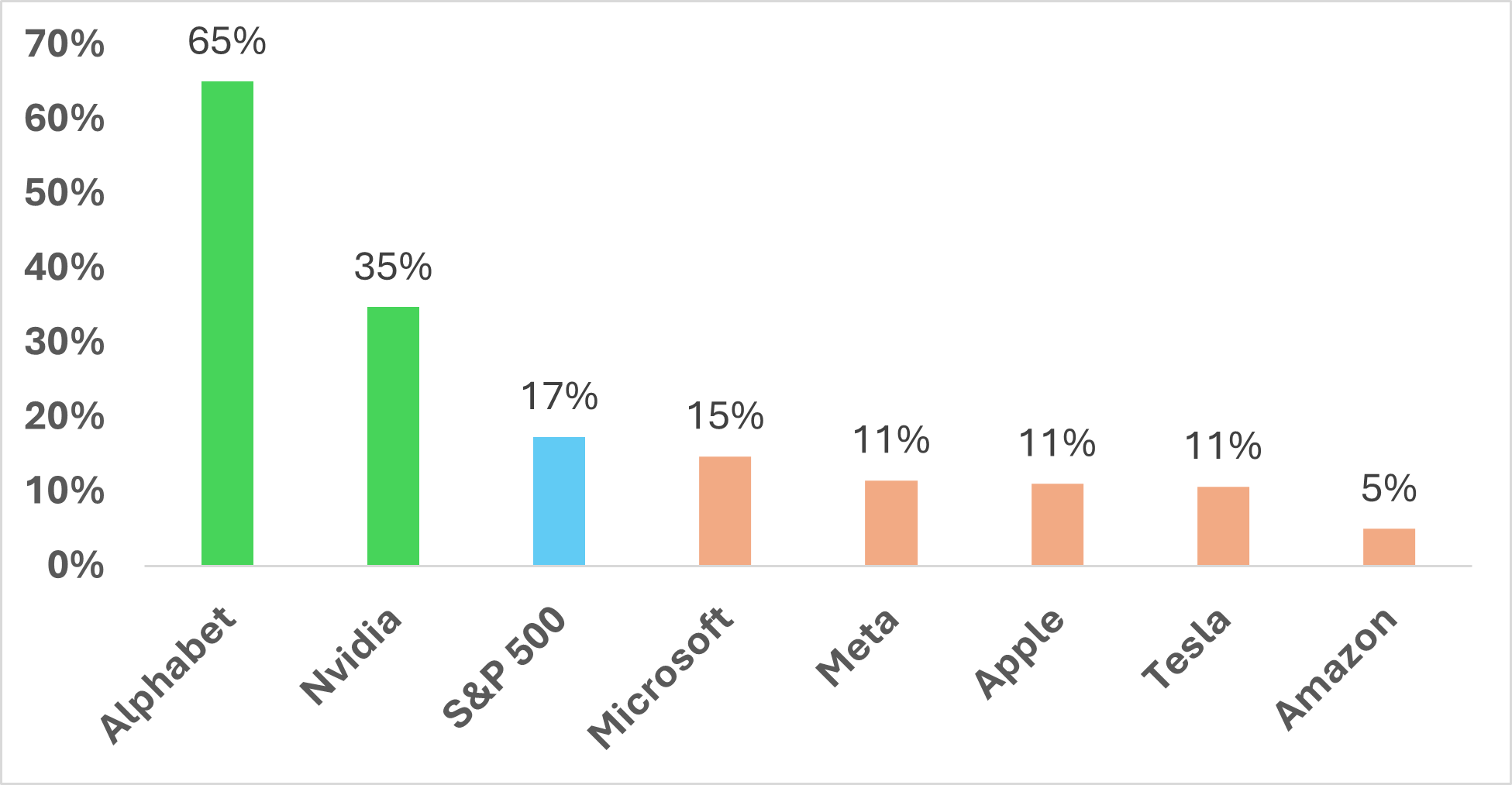

The “Magnificent Seven” – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – have come to symbolise US market dominance. For a time, they appeared to be carrying the entire index.

That perception is starting to shift. In 2025, only two of the seven outperformed the wider US market.

Source: FactSet/7IM, data to 12/12/2025

This is encouraging. It suggests there is a credible path for US equities to continue rising without relying on a handful of mega-cap technology stocks. Banks, utilities, miners and smaller technology firms can all contribute to growth.

Valuations do not need to normalise through failure. A healthier outcome is for more of the market to participate.

If you seek peace, prepare for … peace

By the end of 2026, Donald Trump will be approaching the “lame duck” phase of his presidency. Should mid-term elections reduce his domestic influence, there may be only one realistic ambition left to pursue.

The Nobel Peace Prize.

It may sound flippant, but history shows that US foreign policy is often shaped by presidential ego – not just under Trump. If that leads to further de-escalation of global conflicts, the motivation matters far less than the outcome.

A more peaceful geopolitical backdrop would be a welcome development.

Japan’s rise of the robots

Japan may finally be leaving several decades of stagnation behind it. Public approval of the government is above 70%, providing political headroom for reform under Sanae Takaichi – the country’s first female leader.

Foreign investors are already taking notice, with record inflows of $55.6 billion in 2025.

More interesting still is Japan’s potential role in addressing a challenge many developed economies will face – shrinking workforces and ageing populations. While digital automation adoption remains relatively low, acceptance of physical automation is unusually high.

That makes Japan an ideal testing ground for robotics at scale. Conveniently, many of the world’s leading robotics firms are based there.

Modern Chinese medicine

Traditional Chinese medicine has a mixed reputation – particularly among those with medical training. But modern Chinese biomedical research deserves closer attention.

One striking example from 2025 comes from Zhejiang University. Researchers developed “Bone-02”, a bone adhesive inspired by how oysters attach to rocks in wet environments. The compound sets in three minutes, requires no surgery and is fully absorbed by the body within six months.

China recorded more biotechnology IPOs than the US in 2025, and its medical universities now publish a comparable volume of research and clinical trial data.

Further breakthroughs in 2026 would not be a surprise.

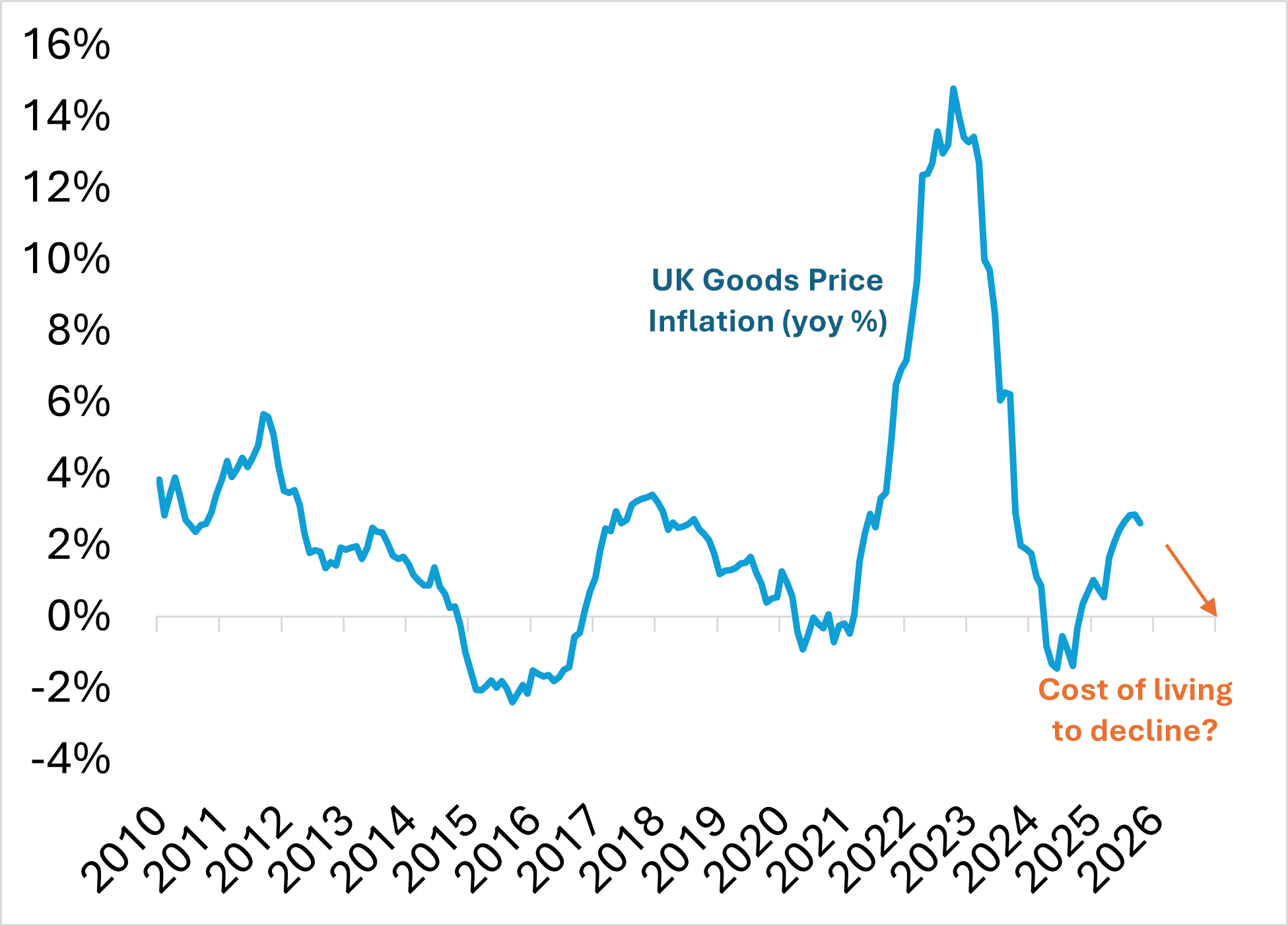

Prices that feel lower

Inflation is as much emotional as mathematical. Most people do not track price indices. They notice the cost of everyday items – fuel, coffee, lunch – and extrapolate from there.

Recent years have been characterised by “high-price fatigue”. But that may ease. Many consumer commodity prices fell sharply in 2025. Sugar prices dropped by around 20%. Cocoa and olive oil roughly halved. Orange juice fell by about 70%.

Crude oil prices are also down around 20%, with supply exceeding demand – making a sharp rise in petrol prices less likely.

Economists may dislike very low inflation. Consumers may feel differently.

Source: ONS/7IM, 01/10/2025

An unexpected UK upswing

An economic boom in the UK does not feel imminent. Confidence indicators remain subdued. But a path to growth is not implausible – particularly if global conditions remain supportive.

Large-scale, visible investment could make the difference. Nuclear power, upgraded electricity grids, new rail infrastructure and housebuilding all create employment beyond construction itself – from logistics to hospitality.

Equally important is psychology. Few things signal economic momentum more clearly than cranes on the skyline.

With March’s qualifying play-offs approaching, we also wish Wales and Northern Ireland the very best of luck as their own campaigns continue.

Long-term trends matter most when they are viewed through the lens of your own goals and plans.

If you would like to talk through what the outlook for 2026 could mean for you, please use the Get in touch button below.

Your capital is at risk. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.